The Ultimate Guide To Public Adjuster

Table of ContentsSome Known Incorrect Statements About Loss Adjuster Indicators on Loss Adjuster You Need To KnowThe Facts About Loss Adjuster Uncovered

A public insurance adjuster is an independent insurance policy professional that a policyholder might hire to help settle an insurance claim on his or her part. Your insurance provider offers an adjuster at no charge to you, while a public insurer has no partnership with your insurer, as well as bills a charge of as much as 15 percent of the insurance coverage settlement for his or her solutions.

If you're thinking about hiring a public insurer: of any kind of public adjuster. Request suggestions from family as well as partners - public adjuster. Ensure the insurer is certified in the state where your loss has actually happened, and call the Better Service Bureau and/or your state insurance division to look into his or her record.

Your state's insurance division might set the percent that public insurers are permitted cost. Be careful of public adjusters that go from door-to-door after a disaster. public adjuster.

Cost savings Contrast prices as well as conserve on house insurance today! When you submit an insurance claim, your homeowners insurance coverage company will designate an insurance claims insurance adjuster to you.

Unknown Facts About Loss Adjuster

Like a claims insurance adjuster, a public insurer will analyze the damages to your property, help establish the range of fixings and approximate the substitute value for those repair services. The big difference is that rather of working on behalf of the insurer like an insurance policy declares adjuster does, a public insurance claims insurer works for you.

The NAPIA Directory site lists every public adjusting firm needed to be accredited in their state of procedure (loss adjuster). You can enter your city and state or postal code to see a checklist of insurers in your location. The various other means to find a public insurance coverage adjuster is to obtain a suggestion from good friends or household participants.

Most public adjusters keep a portion of the final case payment. If you are dealing with a big case with a possibly high payout, variable in the rate before selecting to employ a public insurance adjuster.

What Does Public Adjuster Mean?

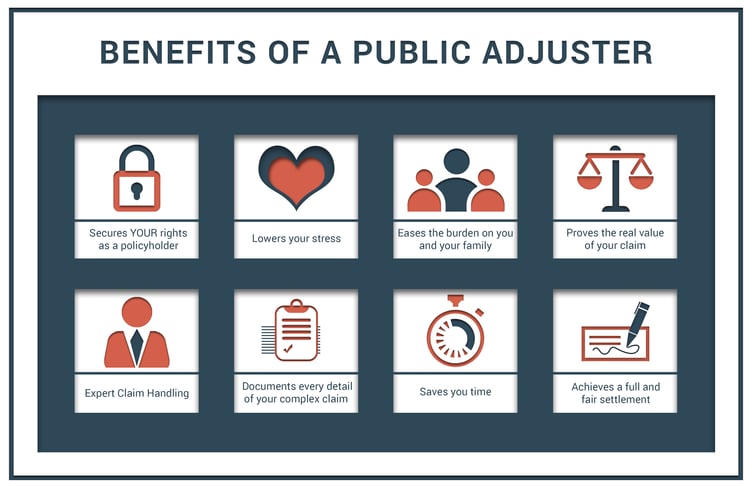

To testify to this dedication, public insurance adjusters are not paid up front. Instead, they obtain a portion of the settlement that they obtain in your place, as managed by your state's department of insurance coverage. A seasoned public insurance adjuster works to achieve a number of jobs: Understand as well as evaluate your insurance coverage Promote your rights throughout your insurance case Accurately and thoroughly evaluate as well as value the range of the building damages Apply all plan arrangements Bargain a maximized settlement in an effective and also effective fashion Collaborating with a seasoned public insurer is just one of the most effective methods to get a quick and also fair settlement on you could try these out your case.

Therefore, your insurer's representatives are not always going to look to reveal all of your losses, viewing as it isn't their obligation or in their best interest. Given that your insurance policy company has an expert working to protect its passions, should not you do the same? A public insurance adjuster can work with various sorts of insurance claims on your part: We're frequently inquired about when it makes feeling to employ a public insurance claims insurer.

Nonetheless, the larger as well as extra intricate the insurance claim, the most likely it is that you'll require specialist aid. Hiring a public adjuster can be the appropriate selection for various sorts of property insurance policy cases, specifically when the risks are high. Public adjusters can help with a variety of beneficial tasks when navigating your case: Analyzing policy language as well as determining what is covered by your carrier Carrying out a comprehensive analysis of your insurance policy Thinking about any recent adjustments in building codes and laws that could supersede the language of your policy Finishing a forensic examination of the building damages, often uncovering damages that can be or else hard to discover Crafting a tailored prepare for receiving the best negotiation from your home insurance claim Documenting as well as valuing the complete extent of your loss Putting together photo proof to sustain your why not check here claim Handling the day-to-day jobs that usually accompany submitting an insurance claim, such as interacting with the insurance business, participating in onsite meetings and sending records Providing your cases plan, including supporting documents, to the insurer Masterfully discussing with your insurer to make sure the biggest settlement feasible The most effective component is, a public claims insurer can obtain entailed at any type of point in the case filing process, from the minute a loss strikes after an insurance coverage claim has actually already been paid or denied.